50% Off Till Midnight!

For Business Owners Looking To Pay 0% Tax

How UK Entrepreneurs Are Quietly Using This 2025 Strategy to Pay 0% Tax in 2025 With This Simple Playbook!

How UK Entrepreneurs Are Quietly Using This 2025 Strategy to Pay 0% Tax in 2025 With This Simple Playbook!

Without dodgy set-ups, without shutting down your current business, and without navigating 'Grey Areas' - This is 100% legal and legit!

Dubai’s 0% tax system is 100% real!

this playbook shows how UK business owners are legally using it to slash their tax bills and protect their profits in 2025.

Look I get it...

You’ve Tried Everything to Lower Your Tax Bill.

Now It’s Time to Eliminate It Legally.

If you run an online business in the UK, this will hit close to home, you've played by the rules.

You’ve taken the advice.

You’ve:

✅ Paid yourself in dividends

✅ Set up an LTD Company

✅ Maxed out pension contributions

✅ Even "hired" your spouse to split the tax load

You’ve paid for the best accountants money could buy.

And yet somehow…

You’re still watching 40-50% of your income vanish like clockwork.

Let’s call it what it is:

You’re still working for HMRC.

And if you’re being honest, it’s starting to feel like no matter how much you earn…

You never really get ahead.

Meanwhile, other entrepreneurs have the same business model, same income level

But they are structuring things differently.

They’re not gaming the system.

They’re just playing a better one.

They’ve moved the business, not the hustle.

They’ve moved the entity, not the ethics.

They’re not hiding money.

They’re just keeping more of it, How?..

They moved their business to a low tax jurisdiction such as Dubai's 0%!

The Dubai Tax-Free Playbook shows you the exact way entrepreneurs are legally setting up their businesses to pay 0% tax!

While still running things globally, banking internationally, and living life on their terms, It's not about dodging responsibility.

It’s about stopping the madness of sending half your hard-earned income to a government that gives you… what, exactly?.. Traffic cameras and tax codes?

If you’re done with patchwork tax hacks…

If you’ve squeezed every deduction your accountant could find…

And you’re still left wondering why you’re working harder than ever but keeping less…It’s time to make a real move.

This playbook shows you how.

Who is this for?

This isn’t for the person just getting started.

It’s not for the guy doing £2k a month from his bedroom and hoping HMRC forgets about him.

This is for real operators.

This is for you if..

You're doing £10k, £20k, £50k/month or more

You’ve built a remote business, coaching, consulting, agency, info products, ecom, SaaS

You’ve already tried to "optimize" your tax situation inside the UK, and the results are... underwhelming

You’re tired of making more just to keep the same

You’re thinking long-term wealth, freedom, and not just next month’s payday

If you're the kind of person who takes calculated risks, not reckless ones…

If you want to build legacy-level wealth, not just quarterly payouts...

If you're ready to stop bleeding 6-figures a year in tax and start building real leverage...

Then this is for you.

Discover How to Legally Reduce Your UK Taxes to 0%! While Living Life on Your Own Terms

£197.00

£29 Today

The Dubai Tax-Free Playbook™

(PDF Guide)

The Dubai Tax-Free Playbook™

Your step-by-step guide to setting up a 0% tax company in Dubai!

Legally, efficiently, and without stress.

Inside, you’ll discover how to:

✅ Register your business in Dubai with 0% corporate and personal tax

✅ Choose the right free zone or mainland setup based on your business

✅ Open business bank accounts and get paid internationally with ease

✅ Avoid common mistakes that cost time and money

✅ Tap into Dubai’s global reputation and credibility, without complex structures

Whether you’re a consultant, freelancer, agency owner, or ecommerce seller, this guide gives you everything you need to start operating tax-free through a Dubai-based company.

INCLUDED

Plus These 3 Bonuses For Free! 🎉 ❤️

free bonus # 1

Business Setup Cost Estimator

(Spreadsheet)

Get a clear, detailed breakdown of what it really costs to set up your Dubai business and start paying 0% tax.

This plug-and-play spreadsheet covers everything from business license fees to visa costs so you can plan ahead with total confidence.

INCLUDED

free bonus # 2

Tax Savings Estimator

(Spreadsheet)

See exactly how much tax you’ll save by moving to Dubai.

This simple spreadsheet compares business and personal taxes in your home country vs Dubai, so you can calculate the real benefit in minutes.

INCLUDED

free bonus # 3

Cost of Living Calculator

(Spreadsheet)

Wondering if Dubai is actually more affordable?

This powerful calculator lets you compare housing, groceries, transport, and lifestyle costs in Dubai vs your current high-tax country.

See where you’ll save, and how much better life can be.

INCLUDED

Here's What People Have To Say...

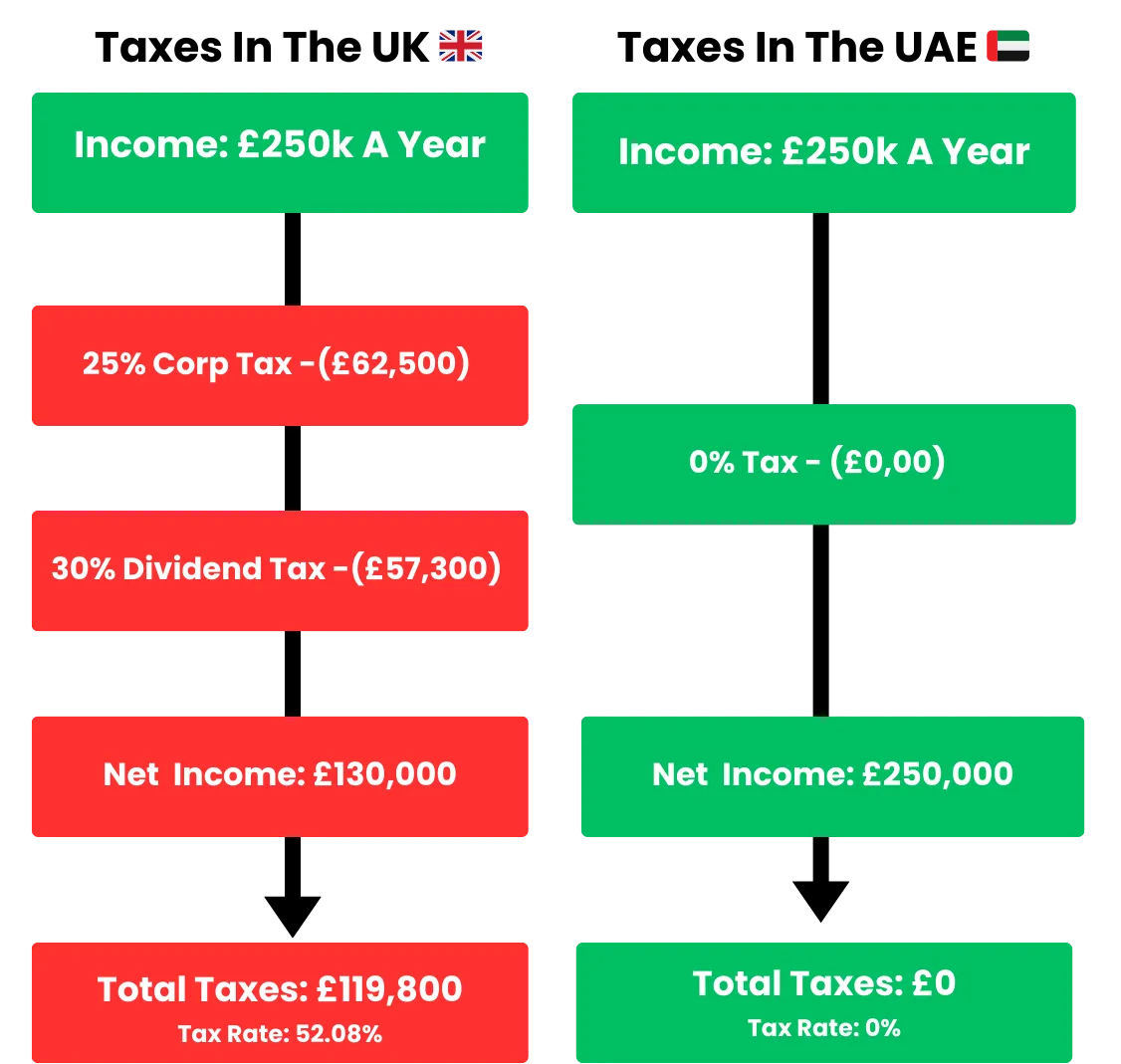

50% Tax vs. 0% Tax

Same Business. Same Effort. One Builds Wealth, The Other Funds the Government.

Let’s break it down:

🇬🇧 Taxes in the uk:

Make £20k/month → Keep £10k

Make £50k/month → Keep £25k

Make £100k/month → Keep £50k

You’re giving away half your income…

Just for existing.

🇦🇪 Structured in Dubai:

Make £20k/month → Keep £20k

Make £50k/month → Keep £50k

Make £100k/month → Keep £100k

You don’t need more sales.

You need a better setup.

Over 5 years?

In the UK: You’ve handed over £500k+

With the 0% Dubai set up: You’ve kept it, invested it, multiplied it.

You’re either buying yourself freedom...

Or buying HMRC another Range Rover.

Your move.

What Surprised Me the Most...

Every Day You Delay Is Costing You

If you're earning £200,000 and paying 50% in taxes, that's:

£274 every day

£1,923 every week

£8,333 every month

Money that should be yours.

Money that you're paying in taxes to a government that doesn't care about you and doesn't give you the services in which you're paying for!

We've Helped Over 1500 People Start Paying 0% Tax ❤️ ✅

50% Discount Applied At Checkout

Get The Dubai Tax-Free Playbook™ Today

The Dubai Tax-Free Playbook™ (Value £197)

Your step-by-step guide to legally paying 0% tax with your Dubai Set Up.

Learn how to:

• Pick the right freezone & business setup

• Open bank accounts

• Avoid costly mistakes

Bonus 1: Business Setup Cost Estimator (Value £59)

Get a clear, detailed breakdown of what it really costs to set up your Dubai business and start paying 0% tax.

This plug-and-play spreadsheet covers everything from business license fees to visa costs so you can plan ahead with total confidence.

Bonus 2: Tax Savings Estimator (value £49)

See exactly how much tax you’ll save by moving to Dubai.

This simple spreadsheet compares business and personal taxes in your home country vs Dubai, so you can calculate the real benefit in minutes.

Bonus 3: Cost of Living Calculator (Value £79)

Wondering if Dubai is actually more affordable to live in??

This powerful calculator lets you compare housing, groceries, transport, and lifestyle costs in Dubai vs your current high-tax country.

See where you’ll save, and how much better life can be.

alternatively you can live in many other areas and you don't need to be stuck to dubai.

Total Value: £384.00

Usual Price: £199

Today's Price: £29

Frequently Asked questions

❓ 1. Do I have to live in Dubai full-time to pay 0% tax?

No, you don’t. To maintain UAE tax residency, you only need to spend one day in the country every 180 days. That means you can live full-time in Dubai, or just visit twice a year while spending the rest of your time in Bali, Europe, Thailand, or wherever else you want. As long as you meet the minimum presence requirement and avoid becoming a tax resident elsewhere, you can legally keep your 0% tax status.

Is it really legal to pay 0% tax? This sounds too good to be true.

Yes - it’s 100% legal. The UAE’s tax system is designed to attract business owners and investors.

You’re not evading taxes, you’re relocating to a country that doesn’t charge personal income tax, dividend tax, or capital gains tax.

Thousands of entrepreneurs have already made the move, and this course shows you exactly how to do it the right way, step-by-step and fully compliant.

How long does it take to set everything up?

You can be fully set up in 7-14 business days.

That includes forming your company, opening a business bank account, and completing your residency visa process (if you choose to get one).

Many Free Zones allow for remote setup, so you don’t even need to fly in unless your visa requires a quick medical test, which takes just 2–3 days.

What kind of business do I need to run for this to work?

This setup works best if you’re running an online or service-based business - like a marketing agency, coaching/consulting business, eCommerce store, dropshipping, SaaS, freelancing, remote work, trading, or any digital-first model.

As long as your income comes from clients or customers outside the UAE, and you’re not selling physical goods within Dubai, you're good to go.

How much does it cost to get started?

The average setup cost is between $3,000 to $9,000 USD, depending on which Free Zone you choose and whether you add a visa or not. This includes company registration, license fees, visa costs, and bank account opening.

The course comes with a Business Setup Cost Estimator so you can calculate your exact upfront investment and avoid any hidden surprises.

Can I still use Stripe, PayPal, or Wise to get paid?

Yes. Most Free Zones support UAE-based Stripe and PayPal accounts once your trade license and Emirates ID are ready.

If your zone doesn’t support these platforms directly, you can still use your existing UK, US, or EU-based payment accounts and legally transfer the money to your UAE business account using services like Wise or via SWIFT. Everything is legal and fully traceable.

We also have connections for other great processors some which work exclusively with us, and some that we've used for years which are proven to be great!

Will I still owe taxes in my home country after I move?

That depends on how you handle your tax exit. If you're from the UK, Canada, or Australia, you’ll need to properly sever tax ties- by submitting official forms, stopping the use of local accounts, and avoiding too much physical presence each year.

The course walks you through this in detail with country-specific exit checklists.

For US citizens, you’ll still need to file annually - but you can use the Foreign Earned Income Exclusion (FEIE) to reduce or eliminate your tax bill.

What’s the difference between a Free Zone and a Mainland company?

A Free Zone company is usually the best option for online businesses.

It’s 100% foreign-owned, easier to set up, and doesn’t require a local sponsor or office.

Mainland companies are for those who want to trade directly with UAE businesses or government contracts, but they require more paperwork, cost more to maintain, and usually involve more regulation.

For 99% of entrepreneurs, a Free Zone setup is faster, cheaper, and more flexible.

❓ 9. Can I sponsor my spouse and children for residency?

Yes. Once your company is registered and you’ve secured your visa, you can sponsor your immediate family for UAE residency too.

This includes your spouse and children, giving them access to schools, healthcare, and long-term residence.

The process is straightforward and covered step-by-step inside the course.

What happens if I leave Dubai for more than 6 months?

If you're outside of the UAE for longer than 180 days, your residency visa may be cancelled.

That means you'd need to reapply if you wanted to keep your tax residency. To avoid this, just make sure to enter the country at least once every 6 months. It can be a short trip even a weekend counts.

We recommend setting calendar reminders to make sure you stay compliant.

Is the healthcare system in Dubai any good?

Yes! it's excellent. Dubai offers world-class private healthcare with modern hospitals, short wait times, and English-speaking staff.

Health insurance is required for residents, and policies are surprisingly affordable, starting from around AED 2,000 per year (roughly $545 USD).

You can choose global providers like Bupa, AXA, or Cigna for international coverage as well.

Isn’t Dubai super expensive to live in?

Not when you factor in 0% tax.

While rent and lifestyle costs can vary, most people find Dubai cheaper than cities like London, Sydney, or Toronto once you stop giving away 40–50% of your income to taxes.

Plus, the standard of living is higher:

You get sunshine every day, luxury amenities, fast internet, and cleaner, safer neighbourhoods.

Do I need to speak Arabic to live or do business in Dubai?

No. English is the primary language of business, education, and daily life in Dubai.

You can register a company, attend meetings, see a doctor, and go about your day entirely in English.

All government forms and business documents are provided in English, and most locals and expats speak it fluently.

Is this course beginner-friendly? I’ve never done anything like this before.

Absolutely. The Playbook is designed to be plug-and-play, with clear explanations, checklists, and templates to walk you through every step.

Even if this is your first time starting a company abroad. Whether you're a seasoned entrepreneur or just getting started with online income, you'll find this course easy to follow and highly actionable.

Can I move to Dubai if I’m not earning six figures yet?

Yes. You don’t need to be making $500K+ to benefit.

Even someone earning $50K–$100K/year can save thousands annually, plus enjoy better quality of life and faster business growth. The earlier you make the move, the more money you keep long term, and the fewer bad tax habits you have to unlearn.

Will moving to Dubai affect my citizenship or passport?

No. Moving to Dubai doesn’t affect your existing citizenship.

You keep your current passport, and you don’t have to give up anything.

Dubai gives you residency, not citizenship.

You’re just legally becoming a tax resident of a better jurisdiction.

Can I buy property in Dubai as a foreigner?

Yes. Foreigners can buy freehold property in designated areas like Dubai Marina, Downtown, JVC, and The Palm.

There’s no property tax, and no capital gains tax.

Buying property worth AED 750K+ (~$204K) can even qualify you for a 10 year golden visa.

Renewable every 10 years as long as you own a property over $204k

Can I use my UAE company to work with clients internationally?

Absolutely. That’s the whole point. UAE Free Zone companies are perfect for global operations, whether your clients are in the UK, US, Australia, Europe, or beyond. There are no restrictions on working internationally as long as your income comes from outside the UAE.

Do I need a local partner or sponsor for my company?

No. In the past, UAE mainland companies required local sponsors, but Free Zones are 100% foreign-owned.

You keep full control of your business, your bank accounts, and your profits.

What’s the internet speed and infrastructure like in Dubai?

Dubai has some of the best infrastructure in the world. Internet speeds are fast and reliable (typically 300–500 Mbps for home or coworking spaces). Coworking spaces, cafes, and home Wi-Fi are all high standard—ideal for remote work or running a global team.

Can I get a driver’s license or car in Dubai?

Yes. Once you're a resident, you can easily apply for a UAE driver’s license. If you're from countries like the UK, US, EU, Australia, or Canada, you can swap your license without taking a driving test. Buying or leasing a car is fast, and fuel is cheap compared to most Western countries.

Is Dubai safe for families, women, or solo travelers?

Extremely safe. Dubai ranks among the safest cities in the world. Crime rates are low, people leave laptops at cafés unattended, and women feel safe walking alone—even at night. It's ideal for families, solo entrepreneurs, and anyone looking for peace of mind.

Got Any Questions?

Fill them out below and leave your Whatsapp and i'll be sure to get back to you

All Rights Reserved.

Privacy — Terms — Disclaimer